Who Is Attorney Vestalia Aylsworth? Will The Florida Bar Investigate Deadbeat Miami Lawyer For Being Stopa’s New Patsy Lawyer?

Who is Miami attorney Vestalia Aylsworth? Why is this down-on-her-luck Georgetown Law School Alumnus deadbeat palling around with a disbarred fraudster like Mark Stopa?

The Sad Life Story of Daddy’s Deadbeat Disappointment

Our darling Georgetown alum’s troubles started way back in 1999. She filed Chapter 7 Bankruptcy less than 5 years from graduating Georgetown Law. Vestalia was heavily in debt and bankrupt. Obviously, her high profile Miami lawyer father, William “Bill” Aylsworth, didn’t teach her financial management like most parents do. Vestalia’s lack of basic life skills would plague her the rest of her life.

Our darling Georgetown alum’s troubles started way back in 1999. She filed Chapter 7 Bankruptcy less than 5 years from graduating Georgetown Law. Vestalia was heavily in debt and bankrupt. Obviously, her high profile Miami lawyer father, William “Bill” Aylsworth, didn’t teach her financial management like most parents do. Vestalia’s lack of basic life skills would plague her the rest of her life.

By March 2003, she was in trouble again. The HOA for her condo complex filed a lien for years of unpaid assessments. She became desperate to avoid an association foreclosure. She needed fast cash. So, she mortgaged her condo to the now-defunct Washington Mutual in January 2005 for $139k.

However, she soon learned living the Ricky Martin La Vida Loca high life in Miami is expensive. As a result, she was soon out of cash. So, she did another cash out refi for $190k in August of that same year.

However, despite being a prestigious Georgetown Law graduate, she wasn’t a very successful lawyer. It appears she wasn’t making any money. If she was, she was spending the money on boy-toys and excessive partying. Aylsworth’s excessive partying became so bad that she couldn’t even pay her HOA fees. As a result she had to do another cash-out refinance from her rising equity.

The Party Comes To End For Miami Attorney Vestalia Aylsworth

Aylsworth soon learned that all good things come to end. In September 2008, the financial crisis hit. Florida real estate values plummeted. Aylsworth couldn’t borrow anymore money to feed her addiction of partying.

Aylsworth soon learned that all good things come to end. In September 2008, the financial crisis hit. Florida real estate values plummeted. Aylsworth couldn’t borrow anymore money to feed her addiction of partying.

Several months later, HSBC Bank filed a foreclosure against her in March 2009 (Case # 09CA-17510). They were seeking money on a mortgage that she hadn’t paid on in years. Her HOA also filed another lien the very next month for over $3,400 in unpaid assessments.

Aylsworth continued to get smacked in the face with the realities of her years of partying. In April 2010, Sallie Mae filed a lawsuit against Aylsworth (Case # 10CA-24407). Sallie Mae alleged she had not paid a dime on her Georgetown Law student loans.

The Condo association was back again in September 2011. They filed a lien for unpaid assessments in the total amount of $20,213.85. The deadbeat attorney was basically squatting in her condo rent free.

Aylsworth’s Debts Begin To Mount

Things got worse in April 2012. Capital One Credit Card filed a lawsuit against our darling deadbeat lawyer (Case #2012-CA-7523) over a balance of $2,785.21. What kind of elite Miami Beach lawyer defaults on a capital one card over a couple grand?

Things got worse in April 2012. Capital One Credit Card filed a lawsuit against our darling deadbeat lawyer (Case #2012-CA-7523) over a balance of $2,785.21. What kind of elite Miami Beach lawyer defaults on a capital one card over a couple grand?

By July 2012, the Mutiny on the Bay COA got tired of her bullshit excuses. Another lawsuit for not paying her bills. The COA filed a foreclosure case over the unpaid COA fees (Case #2012CA-27538).

And 2013 didn’t bring any good news for our darling deadbeat lawyer. Mortgage lender HSBC Bank got tired of all her bullshit lies about the “check is in the mail.”

They refiled the foreclosure complaint (Case #2013CA-2153) against her condo on January 29, 2013.

Court records indicate she hadn’t made a mortgage payment in years. To compound problems, a process server filed an affidavit alleging Aylsworth was avoiding service.

Life Keeps Getting Harder For Deadbeat Attorney Vestalia Aylsworth

In 2014 consumer lawyers were raking in the cash thanks to the financial crisis. Just ask Mark Stopa! However, Aylsworth seemed to be an exception to this. Things just kept getting worse for the fledgling Georgetown grad.

On May 19, 2014, One of her clients, Nexgen Special Assets, filed a lawsuit against her (Case #14CA-13111). Nexgen alleged legal malpractice and breach of fiduciary duty. They also alleged Aylsworth bungled a post judgment enforcement contingency fee agreement. They also alleged Aylsworth skimmed an excessive contingency fee percentage from settlement funds. Thus, she got caught with her hand in the cookie jar. This Sounds a lot like her pal disbarred lawyer Mark Stopa.

On May 19, 2014, One of her clients, Nexgen Special Assets, filed a lawsuit against her (Case #14CA-13111). Nexgen alleged legal malpractice and breach of fiduciary duty. They also alleged Aylsworth bungled a post judgment enforcement contingency fee agreement. They also alleged Aylsworth skimmed an excessive contingency fee percentage from settlement funds. Thus, she got caught with her hand in the cookie jar. This Sounds a lot like her pal disbarred lawyer Mark Stopa.

All the stress from Vestalia’s fucked up life was just too much for her law partner and father, William Aylsworth. He had expected Vestalia to be so much more successful by this point in her life.

Instead, she was destroying the law firm her father built. Vestalia’s hard partying, bumbling incompetence and legal malpractice was too much for him. Friends say Bill was so disappointed with Vestalia he died of a broken heart in August 2014.

Vestalia was Daddy’s little girl. However, despite sending her to one of Florida’s elite prep schools, Vestalia was a complete failure in life. In addition, her father also used political connections from his days at the Pentagon to get Vestalia into Georgetown. Yet, Vestalia was a complete failure in life.

The last straw that literally killed him is when Vestalia moved in with her lesbian lover. Her father finally realized that his grandkids would have to live with the stigma of having two mommies.

Deadbeat Lawyer Commits Tax Fraud And Faces More Lawsuits For Unpaid Bills

In March 2017, the Miami-Dade property appraiser filed a tax lien against Aylsworth. They claimed she was falsely stating under oath that her condo was her homestead. In turns out, Aylsworth had moved in with her lesbian lover. She began renting out the Mutiny Bay condo in 2012. She continued to rent out the condo until 2016.

Aylsworth was collecting rent and not paying her HOA or Mortgage payments. So, she threw caution to the wind and went for the deadbeat trifecta. She screwed Miami-Dade taxpayers by out of $9,500 in homestead exemption credits that she was not entitled to.

Aylsworth was collecting rent and not paying her HOA or Mortgage payments. So, she threw caution to the wind and went for the deadbeat trifecta. She screwed Miami-Dade taxpayers by out of $9,500 in homestead exemption credits that she was not entitled to.

Our Georgetown darling faced more financial hardships in 2018. In September 2018, her Condo Association won a final judgment of foreclosure, (Case #2012CA-27538) against Aylsworth for $114,133.48. The COA scheduled the foreclosure auction for December 5, 2018.

Aylsworth filed a bogus appeal with the 3rd DCA regarding the HOA foreclosure judgment. She managed to stall for time. However things didn’t improve for her in 2019. HSBC Bank filed a new foreclosure lawsuit on January 9, 2019 (Case #2019CA-763). The lawsuit alleged Aylsworth hadn’t made a mortgage payment since 2014.

Her condo was eventually sold at a HOA foreclosure auction. The certificate of title was issued to a new owner on July 15, 2019. Alysworth apparently was back squatting in the condo after breaking up with her lesbian lover. She refused to get out of the condo and a writ of possession was issued and Aylsworth was kicked to the curb by sheriff’s deputies on July 27, 2019.

Aylsworth moved back in with her mother hoping to inherit the free & clear home as soon as mom has the accident. She also set up he law firm at in her old bedroom filled with stuffed animals and her Barbie doll collection.

Practiced Party Girl Attorney Vestalia Aylsworth Hooks Up With Mark Stopa

It is around that same time the disbarred Mark Stopa approached the deadbeat attorney. Stopa was looking for licensed attorneys to file his new fraud on the court scams.

As luck would have it, Stopa was in Wilton Manors with his brother Kyle for an LGBTQ hedonistic party weekend. Stopa just happened to bump into Vestalia Aylsworth in a Miami Beach gay bar.

Aylsworth was there for “Lesbian Night.”

Stopa allegedly told her that he and his brother only come for the cheap drinks (isn’t that what all the closeted white boys say?).

As Vestalia tells the story, Mark was grinding up on her friend from the Miami club scene named Joachim. Joachim was a big burly Afro-Caribbean Latin bear who liked to top middle age white guys like Stopa. Joachim began dry humping Stopa. The whole bar watched as Joachim began simulating an African mating dance while he bent Stopa over on the dance floor. Joachim brought Mark back to the table to meet Vestsalia. The two instantly hit it off. After all, Stopa was recently disbarred. He needed a new patsy lawyer for his equity skimming scam.

Before he want back to the hotel with Joachim and Kyle for a three way, Stopa gave Vestalia his number and said to call him as he would like to offer her a job.

Fast forward to today. Now Vestalia Aylsworth is a patsy lawyer for Mark Stopa in his criminal enterprise. Joachim’s whereabouts are unknown. Soon after, Stopa also began making frequent trips to Miami. Did Joachim end up in the same place as Steven Cozzi?

Duval County Foreclosure Surplus Scam 23CC-14195

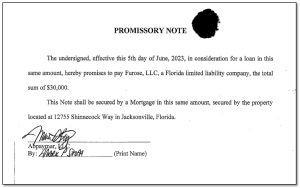

Since his past “equitable lien” foreclosures were so sloppy, Aylsworth advised Stopa to now use a regular mortgage to pull off the scam.

On August 1, 2023 a “2nd mortgage” in the exact amount of $30,000 between Abpaymar LLC (Mark Stopa) and his alter ego Furose LLC (Mark Stopa) was recorded in OR Book 20762, Page 2229.

The 2nd mortgage listed a maturity date of June 4, 2024.

They intentionally kept the amount at $30,000 so they could file their fraud in county court where the judges are far less sophisticated.

It makes absolutely no sense why anyone would make a 2nd Mortgage on a foreclosure home with no equity.

But hey, Stopa and Federico are the dumbest criminal duo in American history.

The Phony Fabricated Furose Note and Mortgage

On September 8, 2023, Vestalia Aylsworth filed foreclosure against Abpaymar LLC in Duval Case # 23CC-14195. The complaint alleges Mark Stopa “failed to pay the note when due and is in default”.

On September 8, 2023, Vestalia Aylsworth filed foreclosure against Abpaymar LLC in Duval Case # 23CC-14195. The complaint alleges Mark Stopa “failed to pay the note when due and is in default”.

There is only one problem with the fraud on the court complaint. The recorded mortgage lists a maturity date of 1 year.

Aylsworth filed foreclosure after the first month citing Mark Stopa didn’t pay what was due which doesn’t make any sense but we guess its probably hard to keep everything logical when you’re a compulsive lying lawyer.

Also, if you look at the court docket, Mark Stopa was served on 9/22/2023 and he did NOT respond to the lawsuit. Therefore, a default was issued against Abpaymar LLC on 10/18/2023.

If you know Mark Stopa, you know this is absolutely unbelievable. Stopa is a highly litigious vexatious litigant. Thus, he would NEVER let someone file foreclosure against him without a years long fight. Are we now supposed to believe that he just gave up and failed to answer?

Aylsworth filed a motion for summary judgment on 10/20/2023 and there is a hearing to set a sale date on 12/19/2023. Stopa is nowhere to be found. He is SILENT on the entire lawsuit. Why? Because he wants to be foreclosed on. He is not answering or defending because STOPA IS SUING HIMSELF to create a fabricated foreclosure judgment. This way he can get the property to auction sale as quickly as possible.

Stopa needs to beat Bank of America to the auction block. But, why? So, he can trick an unsophisticated auction buyer in to overbidding on his bogus judgment so he pockets a massive surplus payday.

Stopa and Federico are excited about this new Duval scam. They expect to haul in a few hundred thousand dollars.

Aylsworth Has Filed a Fraud on the Court And Needs to Be Disbarred

Aylsworth colluded with corrupt disbarred attorney Mark Stopa to file a blatant fraud on the court in order to STEAL from innocent auction buyers. She is using her law license to setup a scam.

Aylsworth colluded with corrupt disbarred attorney Mark Stopa to file a blatant fraud on the court in order to STEAL from innocent auction buyers. She is using her law license to setup a scam.

In the end, innocent auction bidders like Christopher Dennison and senior citizens Russell Layton and Jessy Joseph will lose hundreds of thousands of dollars and get stuck with negative equity property being foreclosed by a senior mortgage lender while Stopa and Federico pocket all their money.

Aylsworth’s filing in Duval 23CC-14195 will be the cause of all of this.

Unbelievable isn’t it?

What a scam. Why rob a bank when you can just manipulate and deceive the county clerk and clueless judges to do the stealing for you.

Aylsworth needs to lose her law license. She is a clear and present danger to the people of Florida.

Maybe someone should warn Judge Michael Bateh about the new Mark Stopa Scam before it is too late… and maybe it’s time the corrupt Florida Bar redeems themselves and does something to actually protect the public by suspending Aylsworth so she can’t file any further frauds on the court for Stopa.

(Hey Vestalia… if you value your law license you should probably STOP filing frauds on the court for Mark Stopa)

Also, Check Out More Stories About The Endeavors of the Stupid Stopas:

The Mark Stopa Investigations Are Being Watched By Anonymous

Sharon Stopa Once Had A Restraining Order Issued Against Her

Mark Stopa Appears To Have Debilitating Mental Health Issues

Was The Stopa Law Firm A House Of Sexual Depravity?

Judge Michael Andrews Masculinity Questioned By Mark Stopa

Fraudster Mark Stopa Admits To Being Under a RICO Investigation

Stopa Consigliere Lee Segal Taken Down

Is Gary Stopa Selling His Little Red Corvette to Pay Legal Bills?

Judge Anthony Rondolino Colluded With Disbarred Attorney Mark Stopa

Is Adrienne Federico is Eating Herself to Death Due to Stress?

The Mark Stopa Disbarment: The Truth Vs. Mark Stopa

Is Gary Stopa the Real Ruler of the Stopa Crime Family?

Is Otis Elevator Salesman Kyle Stopa Part of the Stopa Crime Family?

Did Missing Steven Cozzi Know The Dirty Secrets Of Mark Stopa?

The SS Mark Stopa Is Sinking Fast!

How Florida Grinch Mark Stopa Stole a $2.1 Million Christmas

Whistleblowers Bust The Stopa-Federico Crime Family AGAIN!

Mobster Mom Adrienne Federico Busted In Another Scam

Scumbag Mark Stopa Busted Stealing From Elderly Clients

Mark Stopa Scam Alert: The Christopher Dennison Story

Ethical Misfit Mark Stopa Called Out By Legal Website

Let’s also take a moment of silence to remember the Mark Stopa Victims who lost millions to his scam over the last several months:

Over $60 Million STOLEN by Mark Stopa and the Federico Crime Family

PROOF MARK STOPA OWNS AND CONTROLS ALL PLAINTIFF AND DEFENDANT ENTITIES

DOWNLOAD STOPA CRIME DOSSIER 2.0

DOWNLOAD STOPA CRIME DOSSIER 1.0

This is just a small sample of victims. The Stopa-Federico Crime Family also has dozens of shell companies running the same scam in multiple counties throughout the State of Florida.

Are You A Victim Of One Of The Stopa-Federico Crime Family Real Estate Or Foreclosure Surplus Scams?

Are you a former Mark Stopa client who lost their home?

IF YOU ARE A FORMER MARK STOPA CLIENT – IT’S NOT TOO LATE TO CONTACT INVESTIGATORS AND GET YOUR CLAIM ON THE RECORD!

Click here to contact FDLE today if you are victim of Mark Stopa or have further details about his scams. You Can Also Contact Us Here.

You can also read more about Mark Stopa on MarkStopaVictims.com

No More Tick Tock, You Dumbass Lying Thief.

You are now out of time.

Let the show begin